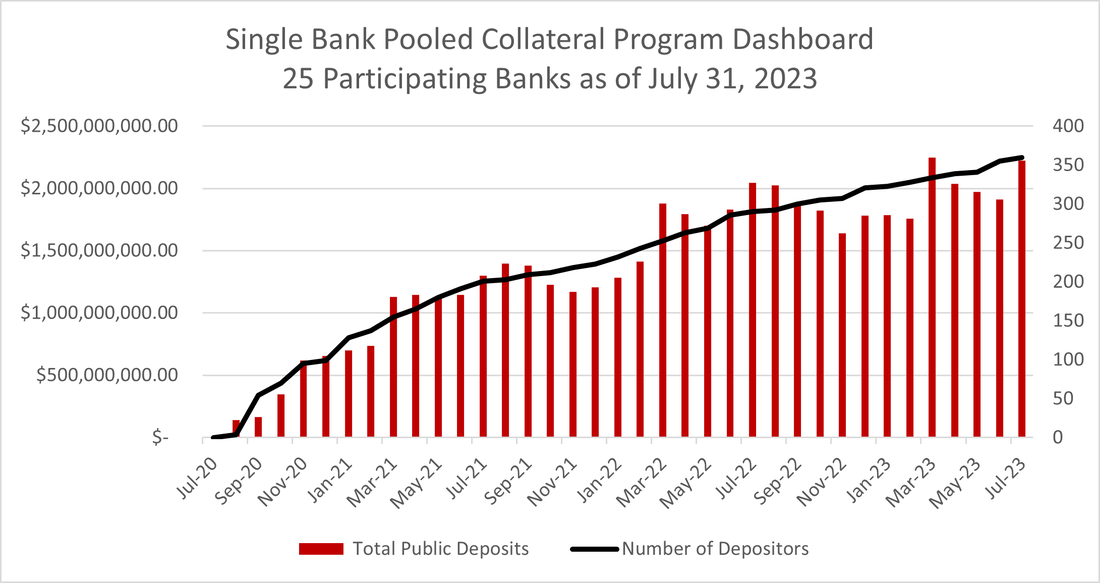

Single Bank Pooled Collateral Program

Nebraska State statute requires Nebraska banks to pledge approved collateral for public entity deposits in excess of FDIC insured limits. The Nebraska Department of Banking and Finance (NDBF) has appointed the Nebraska Bankers Insurance and Services Company (NBISCO), the for-profit subsidiary of the Nebraska Bankers Association, to administer the Nebraska Single-Bank Pooled Collateral Program (SBPC) pursuant to Neb.Rev.Stat. Section 77-2398(2) (b) (ii).

This program allows participating banks to aggregate their total public deposits and to pledge collateral against its entire portfolio of public deposits rather than pledging per entity. As the program administrator, NBISCO collects, confirms and reports bank compliance with mandated pledging requirement on a monthly basis. Collateral is pledged to NBISCO. In the event of a bank closure, the pledged collateral would be assigned to the NDBF for liquidation and payment to impacted political subdivisions.

This program allows participating banks to aggregate their total public deposits and to pledge collateral against its entire portfolio of public deposits rather than pledging per entity. As the program administrator, NBISCO collects, confirms and reports bank compliance with mandated pledging requirement on a monthly basis. Collateral is pledged to NBISCO. In the event of a bank closure, the pledged collateral would be assigned to the NDBF for liquidation and payment to impacted political subdivisions.

Learn How the SBPC Can Benefit Your Bank |

Learn About Public Depositors and the SBPC |

|

|

|

|

Enroll

Instructions and Information Frequently Asked Questions (FAQs) Step One: Enrollment Form and Program Fees Step Two: Security Agreement Step Three: Custodial Agreement Submit Monthly Reporting Financial Institution: Month end report Qualified Trustees: Month end report Reports Bank Compliance Reports Public Entities with Covered Deposits Participating NE Financial Institutions |

Documents

Securities Pledged & Release Form Form to update the list of authorized employees List of Acceptable Collateral Sample Letter of Credit Application for FHLB Related Links Information for Public Depositors Nebraska Bankers Insurance Services Company (NBISCO) Nebraska Department of Banking and Finance Public Funds Deposit Security Act Educational Program Handout PowerPoint Slides for Banks PowerPoint Presentation |